6 Options for the Best Business Accounts in Singapore

If you’re in the early stages of building your business, having a business account will help make tax work, accounting, and expense tracking easier. Besides, wouldn’t it be unprofessional to tell a client or an employee to deposit or cash out from your personal account?

So, if a corporate account’s what you’re looking for, then this article is for you. We’ve rounded up our picks of the best business accounts in Singapore to save you some time.

We also added a brief discussion on what you should consider when opening a business account. And if you still have questions afterwards, you can also check out our list of FAQs for more information.

How Much Do Business Accounts Cost in Singapore

Business accounts in Singapore have different investment rates, minimum deposits, and maintaining balance requirements. So, you’ll have to enquire about these details directly from your bank.

However, you’ll also be spending money while preparing documents for your business account setup. Here are averages for all these costs:

| Types of Cost | Average Cost |

| Registration fee for incorporation | $300 |

| Business name registration for incorporation | $15 |

| Business profile | $5.50 |

| Minimum deposit | $1,000-$10,000 |

| Recurring/monthly fees | $18-$35 |

The Best Banks for Business Accounts in Singapore

Let’s take a look at our picks for the best banks for your business account here in Singapore. With these banks, you can easily track the financial inflow and outflow of your company.

1. Aspire Digital Business Account

| BEST FOR | SMEs and startups |

| PERKS | 100% free, no fees, no minimum balance. 100% free local SGD FAST transfers, with the ability to receive and send funds via PayNow Send and receive USD with free domestic transfers. Low-cost SWIFT payments with a flat $8 fee. Low, transparent FX fees for cross-border transfers Multi-user access Unlimited card issuance 1% cashback on digital and marketing spend Expense Management tools |

| DEPOSIT | No minimum deposit |

| ELIGIBILITY | Businesses registered both inside and outside of Singapore |

| WEBSITE | https://sg.aspireapp.com/ |

| CONTACT DETAILS | 1. Submit ticket via : https://support.aspireapp.com/faq/kb-tickets/new 2. Live chat on website 3. Talk to sales via https://aspireapp.com/pricing |

Aspire Digital Business Account has excellent business solutions with a dynamic financial flow. It offers a convenient, accessible, and secure digital account from which businesses can send and receive money within an instant, anytime and anywhere.

This digital business account features multi-user access so expense management can be convenient for everyone. Additionally, Aspire can issue multiple cards and budgets to manage expenses.

It also values transparency, thus claiming no hidden fees. Thus, Aspire is a great option for SMEs and startups that are still building their way up since they are free.

To add to its transparency, Aspire is also convenient from the get-go up to the maintenance. This is because the application process takes only up to five minutes and because it doesn’t have a minimum deposit.

Aspire is probably the fastest way a business can set up a corporate account, even compared to other fintech players. And they are the only one that does the process a 100% online, even for foreign directors.

Its ease of access doesn’t end with application because Aspire also requires no minimum maintaining balance at all. Additionally, this digital business account is also integrable with accounting accounts like Xero and Quickbooks.

Pros

- Easy, and probably the fastest way to setup an account. Up within days.

- 100% online sign and submission, even for foreign directors

- No additional setup or hidden fees

- 100% free local SGD FAST transfers, with the ability to receive and send funds via PayNow

- Issue unlimited virtual cards with 1% cashback on digital marketing and software subscriptions

- Multi-currency accounts with best FX rates, up to 3x cheaper than banks

- Enjoy low cost SWIFT payments with a flat $8 fee.

- Send and receive USD domestic transfers for free.

- Dedicated support and live chat

- Comes with free integrated receivable management and the option to add-on expense & payable management for businesses with scaling operations. Free local transfers

- Send and receive international payments with low, transparent fees.

- Market lowest exchange rates

- Multi-user access

- Employee claims made easy with one-click reimbursement and accounting syncs

- Unlimited card issuances with budget control

- Accounting integrations to automate your workflow (Xero, QuickBooks, MYOB, Netsuite, Oracle)

Cons

- No option for cheques and cash

- Reliant on your technological capability and security

Customer Reviews

Here’s what a small business owner had to say about his experience with the Aspire Digital Business Account:

“I came across Aspire when we had to receive our long awaited Series-A proceeds, while in the same day we found out that we had problem with our conventional bank account. To my surprise, the Aspire account opening process was so easy and super fast. We had the documents filled (along the process, Aspire’s people were there to guide us on every step) and had the account opened and ready the following day! It was life saving experience for our company. Thanks a lot Aspire!”

2. Volopay Smart Business Account and Corporate Cards

| BEST FOR | Startups, SME’s and Large enterprises |

| PERKS | Corporate cards with interest free credit line upto $500K Super fast approval process Generous cashback on FX transactions No monthly or annual fee Built in flexible approval workflows & budgets Money transfer with best rates Accounting Automation Reimbursement tool included |

| DEPOSIT | No minimum deposit |

| ELIGIBILITY | All businesses registered in Singapore |

| WEBSITE | https://www.volopay.co/sg/lp/business-account/best-in-singapore |

| PAYMENT NETWORK | Visa |

| WELCOME OFFER | Get Apple AirPods once you onboard onto Volopay and reach $3k spend mark |

| CONTACT DETAILS | +65 96236599 |

Volopay is a smart business account that offers payment cards, credit line, money transfer facilities and accounting automation all on a single platform.

By using this platform, modern businesses of all sizes can avail cashback of upto 2% on all their Fx transactions and save a lot everyday as compared to conventional business bank accounts.

We’ve included them on our list because Volopay allows you to allocate individual payment cards to your employees, create strategic budgets, allocate funds, create approval policies and sync all your expenses into your accounting software. Thus, acting as a complete business expense management solution tool over an addition to your business account.

Besides this, another pro is they they have a financial software that manages online subscriptions and syncs all the payments automatically into accounting software like Xero, Netsuite, QuickBooks, and Deskera. As a result, this reduces hours of tracing the invoices or receipts and manually reconciling the bank statement helping to close the books 5x quicker than usual.

Virtual cards can also be tagged to Paypal, Google Pay, and Grab.

We consider them as the go-to solution for SMEs looking for credit facilities for their day-to-day expenses with no hidden interest charges and an extremely quick credit scoring process of 48 hours.

Enjoy these distinct benefits today with no annual charges or cap on minimum spendings!

Pros

- Cashback of 2% on Fx transactions (On all merchants – No Limitation)

- No annual fees or minimum spend

- Credit up to $500K

- Expense management software

- Real-time spend tracking

- Partner benefits up to $35K

- Unlimited virtual cards

- Accounting automation (Xero, Quickbooks, Netsuite, and custom integrations)

- Employee reimbursement tool included

- 24*7 customer support

Cons

- Takes up to 2 days for account approval

Customer Reviews

Here’s what some people have to say about them:

“We use virtual cards to manage all our marketing and SaaS spends. We now have better visibility and control, while earning 2% cashback.” — Mitul Doshi, President Finance & ops – Invideo

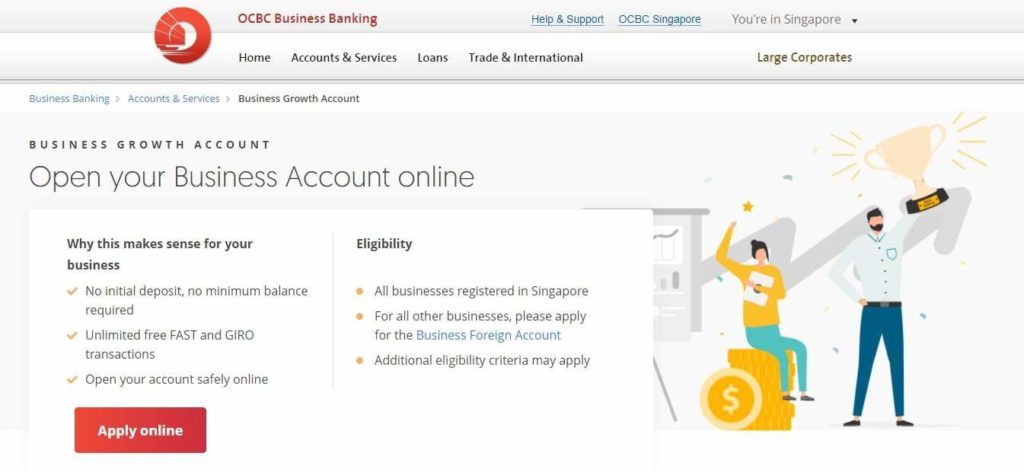

3. OCBC Business Banking

| BEST FOR | Easy application process |

| PERKS | No monthly fees, no minimum balance, unlimited free FAST and GIRO transactions |

| DEPOSIT | No minimum deposit |

| ELIGIBILITY | All businesses registered in Singapore |

| WEBSITE | https://www.ocbc.com/ |

| CONTACT DETAILS | +65 6363 3333 |

OCBC is one of Singapore’s large banks, catering to both large corporations and small businesses. This business provides more than just a place to store and utilise your business funds because OCBC also offers investment banking.

With such feature and its industry experience and constant market research, OCBC guarantees to help its clients grow their finances. It also has credit facilities to fund projects.

Another great thing that OCBC features is its vast industry experience. So, it can provide the same quality of services for healthcare, energy, real estate, technology, and other types of industries.

OCBC also caters to SMEs by providing business loans, thus helping them reach goals faster in a more sustainable and cost-effective approach. To sum it all up, this bank can help you handle all financial aspects of your business with minimal to no cost at all.

It is also compliant with the country’s deposit insurance schemes. However, foreign deposits, dual currency and other investment products aren’t covered by this insurance.

Pros

- Large sum insurance for investments and deposits

- Unparalleled experience across all types of industries

- Up-to-date market research for investment growths

- Cost-effective and sustainable loans for SMEs

Cons

- Limited insurance for investments and deposits

- Relatively fewer financial services

4. DBS Business Account

| BEST FOR | Convenient banking |

| PERKS | No minimum balance, no fall below fees, and wide banking network |

| DEPOSIT | $1,000 |

| ELIGIBILITY | All businesses registered in Singapore |

| WEBSITE | https://www.dbs.com.sg/ |

| CONTACT DETAILS | 1800 222 2200 | +65 6222 2200 |

If you’re looking for the best business accounts in Singapore that’s accessible anywhere, virtually and physically, DBS may be a good choice. This is one of the country’s largest corporate banks, with 900 ATMs on the island alone.

It also has a digital and mobile application to make its services more accessible. However, despite this accessibility, some people still find its customer support to be lacking.

Luckily, with the use of KYC platforms, DBS guarantees fast and seamless transactions. This feature is known to enhance security and reduce risks of identity theft, financial fraud, and money laundering.

To further help its clients, DBS offers project and syndicated financing options. DBS also offers fiduciary services and global trade and supply chain so its clients can venture into more projects.

DBS even offers business insights to help its clients improve their businesses in more ways than one. To improve employee retention and satisfaction, companies can also seek out this bank’s Holistic Wellness Toolkit and relief programmes.

Pros

- KYC registry for seamless transactions and added security

- Wide range of corporate solutions

- Highly-accessible services

- Follows and promotes sustainable financing

Cons

- Not the best customer support

- Requires a minimum deposit amount

5. Standard Chartered Smart Business$aver Account

| BEST FOR | High interest rates |

| PERKS | Online banking, low remittance costs, and high interest rates |

| DEPOSIT | Check their website for more details |

| ELIGIBILITY | All businesses registered in Singapore |

| WEBSITE | https://www.sc.com/sg/business/ |

| CONTACT DETAILS | +65 6747 7000 |

If you’re looking for the best business accounts in Singapore to cater to all your financial needs, then you should consider Standard Chartered. It has among the highest interest rates, with up to 1.68 interest p.a.

Standard Chartered even has two types of interest within its accounts, helping time deposits and investments grow for those with excess funds. This feature alone sets it apart from the other business accounts in Singapore.

This bank also offers a diverse set of services, with payroll, credits, foreign exchange, cash management, insurance, and lending grouped in the Smart Bussiness$aver account. Standard Chartered also guarantees transparency through its monthly consolidated statements.

However, since it focuses more on growing your money, Standard Chartered’s Smart Business$aver has a minimum monthly average of $50,000. If you fall below this, then you’d have to pay a fall-below fee of $50 per month.

Pros

- Two different types of interest in one account

- High interest rates

- Various additional financial services in one account

- Low remittance costs

Cons

- High minimum monthly average

- Less applicable for transactional businesses

6. HSBC Business Account

| BEST FOR | Global banking |

| PERKS | Easy access to cash, dedicated service, 24/7 banking |

| DEPOSIT | Check their website for more details |

| ELIGIBILITY | All businesses registered in Singapore |

| WEBSITE | https://www.business.hsbc.com.sg/ |

| CONTACT DETAILS | 1800 216 9008 |

Among the banks with the best business accounts in Singapore, HSBC may just be the oldest and most experienced, with 140 years of services. With its wide variety of services, it can cater to SMEs and large corporations.

HSBC even has branches in over 53 countries, so it can be advantageous to clients looking to expand their business internationally. That said, it also caters to nine other major currencies to minimise any foreign exchange fees.

This bank also excels in customer support, with numerous hotlines for different concerns to accommodate numerous customers without neglecting others. With this service and its paperless transactions, HSBC guarantees convenience and accessibility.

To promote paperless transactions, it even charges fees for paper transactions. Given that, you’d have to avoid using fax or physical documents to submit or claim loans, settlements, and other financial services.

Pros

- 24/7 online banking and paperless transactions

- Excellent customer support

- Applicable for multinational and expanding companies

- 3-month fee waiver for first-time business accounts

- Applies deposit insurance schemes

Cons

- Imposed fees on paper transactions

- Limited insurance coverage for investments

What to Consider when Choosing Business Accounts

- Security. Security is the most important factor to consider. You should only do business with a bank you trust, and not one that has lax security protocols and untrustworthy policies.

- Monthly fees. Some business accounts charge monthly fees. However, some banks also have none of that and even provide incentives such as interest rates.

- Minimum deposit. Business accounts without a minimum deposit are best for those who are still building a business.

- Minimum balance. If you’re looking to invest, then this won’t be too much of an issue. However, if your business involves constant payments and receivables, then you have to make sure to meet the minimum balance to avoid paying extra.

- Limits on transfers. If your long-term plan includes being a giant in your industry, you’ll have to set up a business account with a large limit on transfers.

- Ease of access. The easier you can access your business account, the easier you’ll handle your business transactions and monitor your cash flow.

- Customer support. Even the best business accounts can have several issues from time to time. So, make sure you are with a bank that can solve, or at least recognise, your concerns immediately.

- Conversion fees. Some banks charge more for international transfers so just make sure you find someone with minimal conversion fees if your clients or partners are abroad.

Frequently Asked Questions about Business Accounts

And that concludes our list of where you can get the best business accounts in Singapore. Any of these banks will surely give you peace of mind in keeping your funds and transactions secure!

Do you think we missed any bank or financial firm offering business accounts? If so, let us know so we can also assess them!

Now, if you’re also looking for someone to help in starting a company, you may need advice from the best business consultants in Singapore. Our list has trusted financial and business advisors to make sure your business is built on the strongest of foundations.