Your Blueprint for Registering a Company in Singapore: A Step-by-Step Guide

When I first considered starting a business in Singapore, I was overwhelmed. The idea of navigating legal requirements, filling out forms, and meeting deadlines felt daunting.

But the allure of Singapore’s vibrant economy and pro-business environment kept me motivated. I discovered the process wasn’t as scary as it seemed. Once you know the steps, it’s surprisingly straightforward.

This guide simplifies it all, helping locals and foreign entrepreneurs start their dream business in Singapore with ease.

How to Register a Company in Singapore

– Media from acra_sg

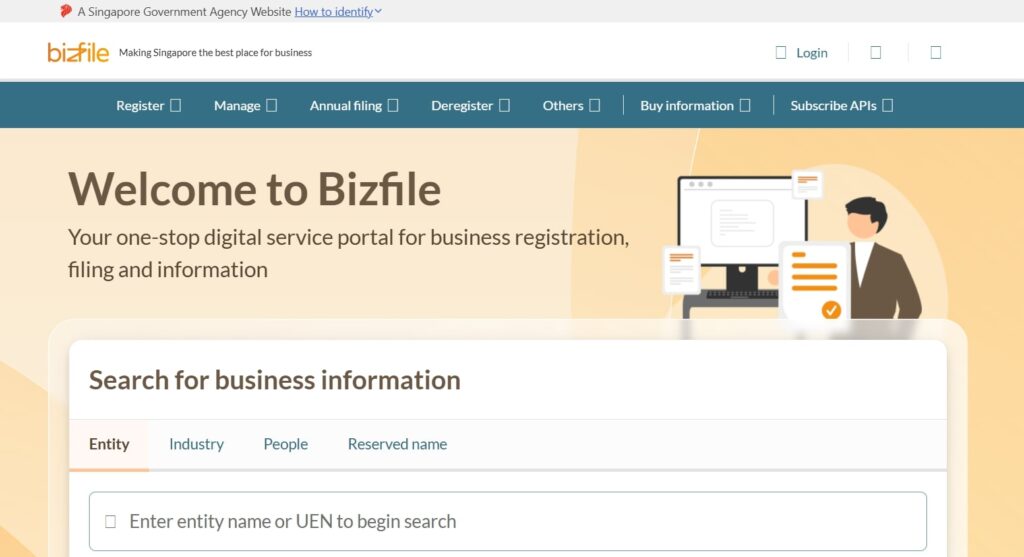

The business registration process in Singapore is overseen by the Accounting and Corporate Regulatory Authority (ACRA), ensuring compliance and transparency.

Registration is done online via ACRA’s BizFile+ portal, a user-friendly platform where you can reserve a company name, submit required documents, and pay fees—all in a matter of hours for most applications.

Pre-Registration Considerations

Taxation in Singapore

When I first learned about Singapore’s corporate tax rates, I was impressed by how competitive they are—capped at 17%, one of the lowest in the world!

For new companies, the Start-up Tax Exemption Scheme is a real bonus, offering significant tax breaks during the crucial first three years of business.

As my business grew, I discovered the importance of Goods and Services Tax (GST) registration, which is mandatory for companies with an annual turnover exceeding S$1 million.

So while it seemed like extra paperwork at first, registering for GST came with benefits like reclaiming input taxes and gaining credibility with larger clients.

Maintaining Company Records and Compliance

During the start of my business, keeping proper accounting records felt like a chore, but I quickly realised how crucial it was for tracking cash flow and making informed decisions.

Clear records also made it so much easier to file accurate returns and stay compliant with regulatory requirements—no last-minute scrambling!

Filing deadlines can creep up on you, so meeting annual requirements with ACRA and IRAS became a top priority.

Lastly, appointing a good corporate secretary was a game-changer. They helped me stay on top of compliance, while an auditor (if required) ensured my financials were in order and credible.

1. Choose a business structure

Choosing the right structure is a make-or-break decision. I learned that each structure—sole proprietorship, partnership, or private limited company—came with its own implications for liability, taxation, and growth.

For me, minimising personal risk and planning for scalability pointed me toward a private limited company. Looking back, this decision shaped how my business grew.

A private limited company offered tax benefits and made it easier to attract investors later on, but a simpler structure like a sole proprietorship might work better for those just starting small. It’s all about understanding your current needs and future goals!

a. Sole Proprietorship

I considered starting small, a sole proprietorship, as it seemed like the easiest route. It’s a business owned and operated by one person, making it straightforward to set up and perfect for small-scale ventures like freelance gigs or home-based businesses.

Plus, there’s less paperwork involved, and you get full control over decisions and profits.

However, I quickly realised the downsides—being personally liable for debts and risks was a big concern. While the simplicity and low cost of maintaining a sole proprietorship are appealing, it lacks scalability and may not be ideal if you’re planning to grow your business in the future.

It’s a great starting point but something to reconsider as you expand!

b. Partnership

At one point, my friend and I decided to team up for a business, so we explored the different types of partnerships. A general partnership is the simplest, where both partners share responsibilities and liabilities equally.

Limited partnerships include at least one general partner with full liability and one limited partner whose liability is capped to their investment. We eventually went with a limited liability partnership (LLP), which offered the flexibility of a partnership but protected us from personal liability for the actions of the other.

What stood out to me was how partnerships balance shared efforts with shared risks. While splitting responsibilities is great, the shared liability in general and limited Partnerships can be risky if something goes wrong.

With an LLP, we had a clear legal structure that suited our needs without compromising personal security—a perfect middle ground for collaboration and protection.

c. Limited Liability Company (LLC)

When I was planning to scale my business, a limited liability company (LLC) felt like the smartest choice. For most entrepreneurs, a private limited company (Pte. Ltd.) is ideal. It’s owned by up to 50 shareholders and perfect for small to medium businesses.

On the other hand, a public company suits larger operations looking to raise capital from the public, though it comes with stricter regulations.

What I loved most about the LLC structure was its perks: it’s a separate legal entity, so my personal assets were protected, and liability was limited to the company’s assets. Plus, tax benefits like corporate tax exemptions made it a cost-effective option, especially compared to other structures.

It’s a solid choice if you’re serious about growing your business.

2. Prepare requirements

Getting the details right felt like piecing together a puzzle when prepping for registration.

First, I had to determine my business activities using Singapore’s SSIC codes, which categorise what your business does. Then came securing a registered office address in Singapore—no P.O. boxes allowed, so I had to find a physical location for official communications.

Next, I needed to gather the particulars of all key players—directors, shareholders, and my company secretary. For a private limited company (Pte. Ltd.), the minimum paid-up capital requirement was just SGD 1, which was a relief.

It was surprisingly simple once I had everything lined up, and I was ready to move on to the actual registration!

The Registration Process (Steps and Procedures)

3. Reserve a business name via BizFile+ (valid for 120 days)

Picking a name for my business was exciting, but I quickly learned there were some rules to follow. The name had to be unique, not identical to existing businesses, and free from offensive or prohibited words.

I also had to check that it didn’t infringe on trademarks—thankfully, BizFile+ flagged any issues during the reservation process.

Once I settled on a name, I submitted it through the BizFile+ portal, and it was approved surprisingly fast. The name reservation is valid for 120 days, giving me plenty of time to complete the rest of the registration.

4. Prepare incorporation documents

This step is like putting my business’s rules into writing. The Memorandum and Articles of Association (M&AA) outlines the company’s purpose, structure, and operational guidelines, essentially acting as its constitution.

While it seemed a bit formal at first, having clear terms helped me set a solid foundation for how the business would run.

Next came getting the consent forms signed—Form 45 for directors and the equivalent for secretaries. These forms confirmed that everyone involved agreed to take on their roles, which felt like rallying a team for a big game.

5. Submit registration application via BizFile+

The final stretch of the long but rewarding journey was when I submitted the registration application on BizFile+. I carefully uploaded all the required documents, like the M&AA and consent forms, making sure everything was in order.

After double-checking everything, I paid the registration fee (which ranges from S$115 to S$315 depending on the business type). It felt like a small investment to officially launch my dream venture.

6. Receive Certificate of Incorporation

Seeing the Certificate of Incorporation pop up in my email was such a proud moment. It was like holding a golden ticket to officially start my business!

Issued electronically upon successful registration, the certificate confirmed that my company was recognised as a legal entity in Singapore. The whole process felt seamless, and receiving the certificate electronically meant no waiting for paperwork to arrive.

With this document, I could now open a corporate bank account, sign contracts, and really kickstart operations. It was the moment everything felt real.

Post-Registration Steps

- Open a corporate bank account

Prepare documents like your Certificate of Incorporation, M&AA, and board resolution. Choose a bank that suits your business needs, such as DBS or OCBC, for smooth transactions.

- Apply for necessary licenses or permits based on business activity

Check if your business activities require specific permits (e.g., food licenses and import/export permits) and apply through relevant agencies.

- Register for GST (if applicable)

The threshold is S$1 million annual revenue. If your annual revenue exceeds S$1 million, register for GST with IRAS to comply with tax laws and enjoy input tax claims.

- Set up accounting and record-keeping systems

Implement systems to track expenses, revenue, and compliance, ensuring accurate financial management and reporting.

- Comply with employment laws (if hiring)

Follow regulations like CPF contributions for employees and draft proper employment contracts to meet Singapore’s labour laws.